As the cost of living crisis is leaving households across the county worse off, it’s no wonder that many people are turning to their employers for a pay rise.

In fact, the number of searches for the term ‘how to ask for a pay rise’ (or similar) has more than doubled since the beginning of 2021.

This makes keeping an up-to-date record of your employees’ salaries and any changes made to their pay even more important than ever.

Keeping Track of Salary Changes and Pay Rises

When you’re recording a pay rise, write down three things:

- The date

- The salary increase

- The total salary

It’s a simple process, sure – but it’s also of vital importance to your business.

Ensuring that these records are accurate and reliable is a must, so recording this information needs to be done immediately after any pay review.

If you put it off until later in the day, the likelihood is that you’ll forget it. The process for updating information should be quick, easy and intuitive, so that you’re more likely to do it straight away.

According to the Office of National Statistics, the average growth in UK employees’ basic pay (without bonuses) was 6.6% in December 2022 – February 2023.

Keeping Salary and Pay Rise Information

Not recording a salary change can impact your business in a number of ways. The most immediate might be that you forget to update payroll information after promising someone a pay rise. They’re sure to let you know when they next check their bank account and find that they’ve been underpaid!

Keeping a salary history record is important for staff review purposes. As well as recording the figures and pay amounts, you’ll want to look back on how often you’re giving raises and how much you’ve increased someone’s pay by.

As well as being significant for the individual, this is handy information to have if you’re employing someone new and need to be reminded about the starting salary of others that joined at the same level.

Of course, the most important reason of all is for HMRC records. HM Revenue & Customs will require salary data, current and past, for tax and NI records. Inaccurate and unreliable information can cause a lot of stress for you, as well as potential fines and legal action if HMRC finds out. It’s a statutory requirement to keep this information.

Download our FREE Salary Increase Letter templates here.

Why is it So Important to Keep Salary Information Separate from Payroll?

It’s essential that you have an easily accessible record of each employee’s current salary, without needing to look through a detailed payroll document. This should be at-a-glance information kept in an employee’s file.

Your staff payroll document doesn’t record all previous wages and salaries, which means that you’d be missing some very important data if you simply updated the payroll.

You’ll find that salary queries typically come up in staff performance reviews, and this isn’t the time to be searching through your payroll software or an extensive Excel document.

It helps to have all of the details about one employee in a space that’s specifically for them. Which is where a their staff record comes in handy as this will also contain important details like sick days taken, disciplinary steps and performance related goals.

Having their staff record in front of you whilst you’re in the meeting will enable you to look back over previous pay rises. This information can form the foundation of any salary decisions that you make during an annual pay review.

Other Things to Remember…

National Minimum Wage

If you have employees that are earning minimum wage, it’s essential to keep track of any national increases that you’ll need to follow within your business.

You should have a system that enables you to quickly check who’s earning minimum wage, and who needs to have their pay raised each time the minimum wage increases.

A clear history of pay rates or salaries will allow you to check back to ensure that none of these necessary pay rises have been missed.

HMRC

HMRC has the right to check records going back up to four years (the original record year, and up to three years from the end of that tax year).

Penalties of up to £3,000 are in place for incomplete records, and HMRC will estimate how much you owe. Any lost records need to be replaced to the best of your ability – cloud storage, with multiple backups, can almost completely remove this risk.

Trying to remember what you’ve paid each employee (for at least the last four years) can be a stressful and time consuming task – and one that’s best avoided!

With robust and secure staff salary records that are updated for anyone that needs to access them, you should avoid unhappy employees and unexpected fines.

Track Salary Information With Staff Squared

The best thing that you can do, in preparation for whatever pay rise questions come your way, is have a comprehensive record of pay rises.

Managing salary information for your employees is made so much easier with Staff Squared.

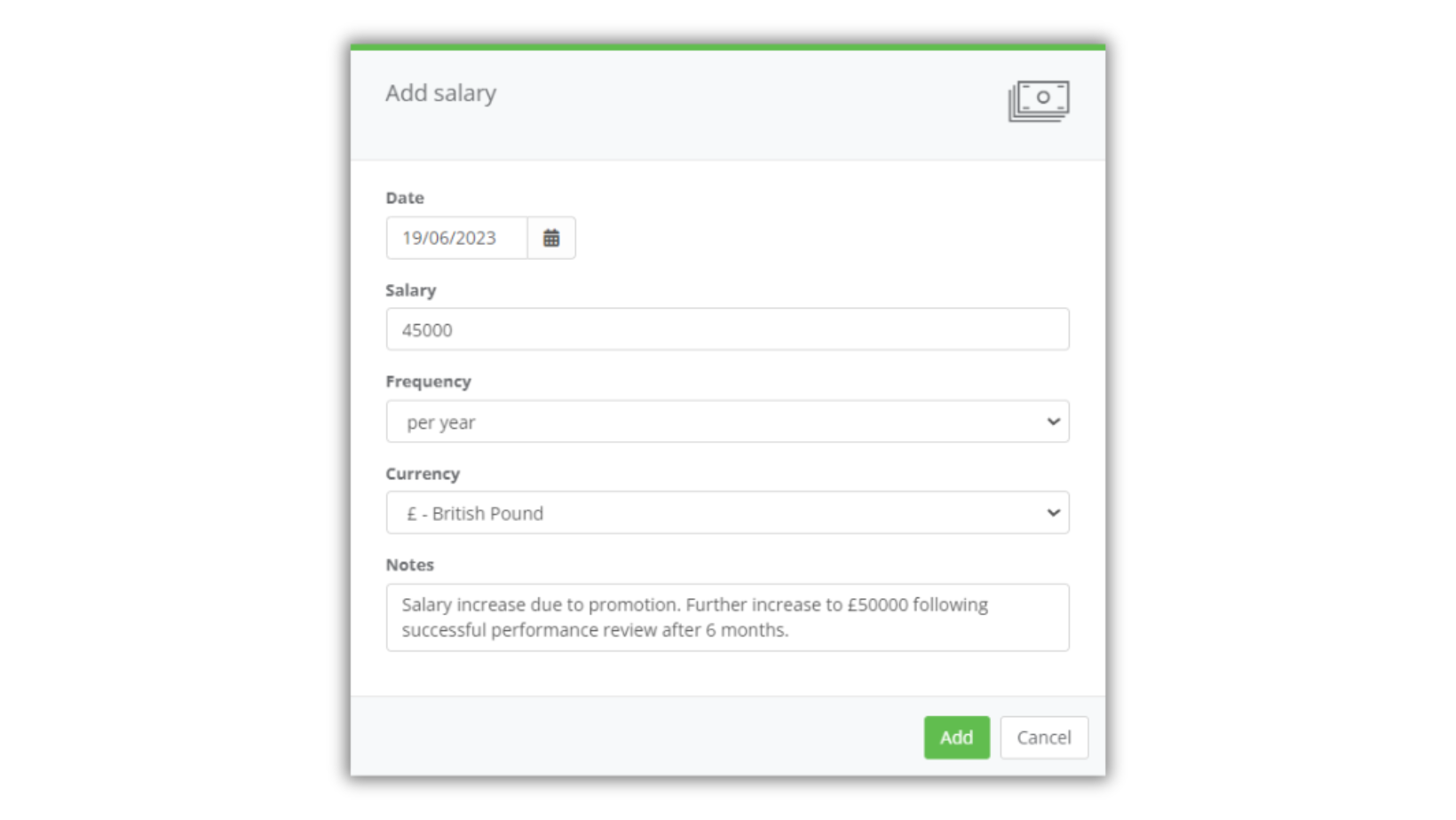

Our simple salary form allows you to record the start date, salary amount, frequency (per hour, day, week month, year or item), currency and any notes you wish to leave.

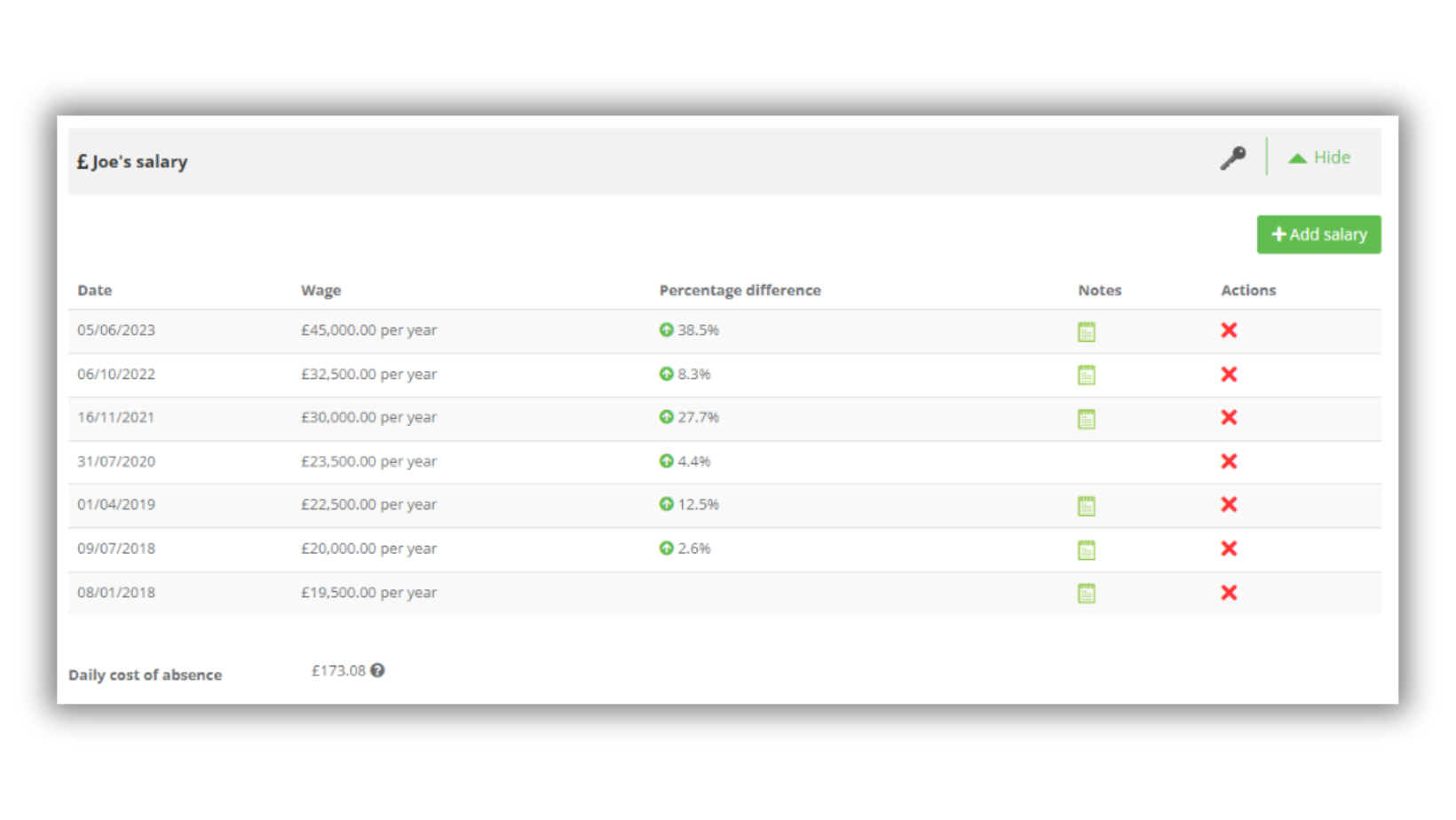

With each new salary entered, you’ll be able to see the percentage difference from the previous salary and the daily cost of absence based on the current salary.

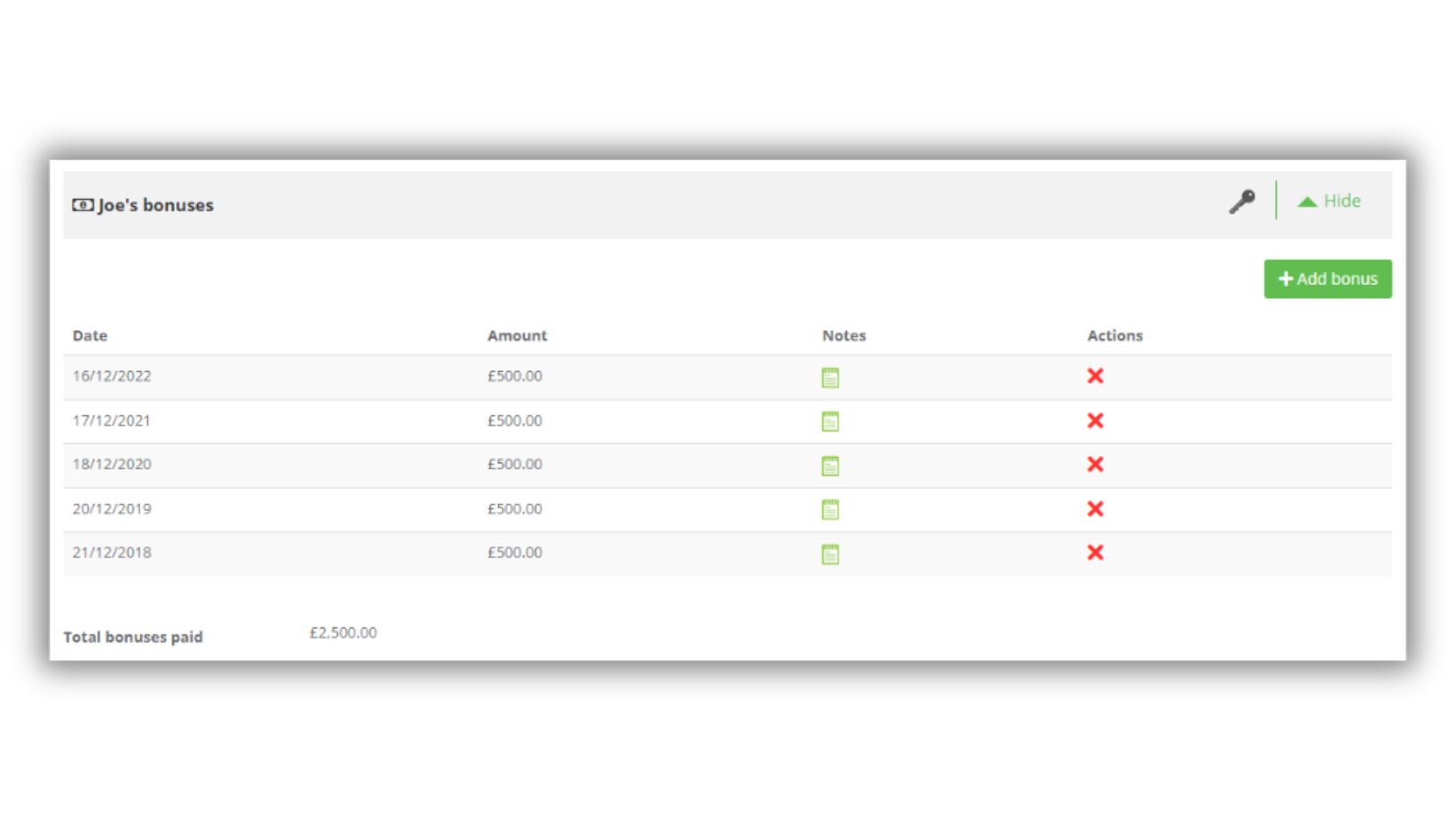

Even record bonuses given to your staff to keep a full and accurate record of the amounts and dates paid.

Salary and bonus information stored is fully reportable, and all data can be exported to assist with your auditing requirements.

Try Staff Squared Now